unlevered free cash flow dcf

Whereas levered free cash flows can provide an accurate look at a companys financial health and the amount of cash it has available unlevered cash flows provide a look at the enterprise value of the company. Internal Revenue Code that lowered taxes for many US.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

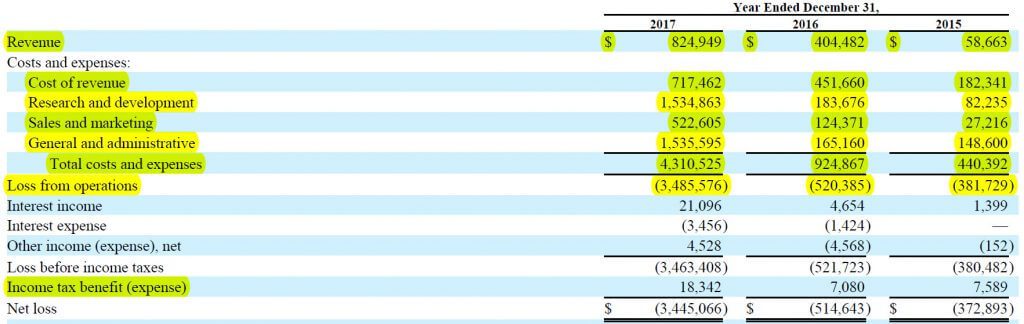

Start with Operating Income EBIT on the companys Income Statement.

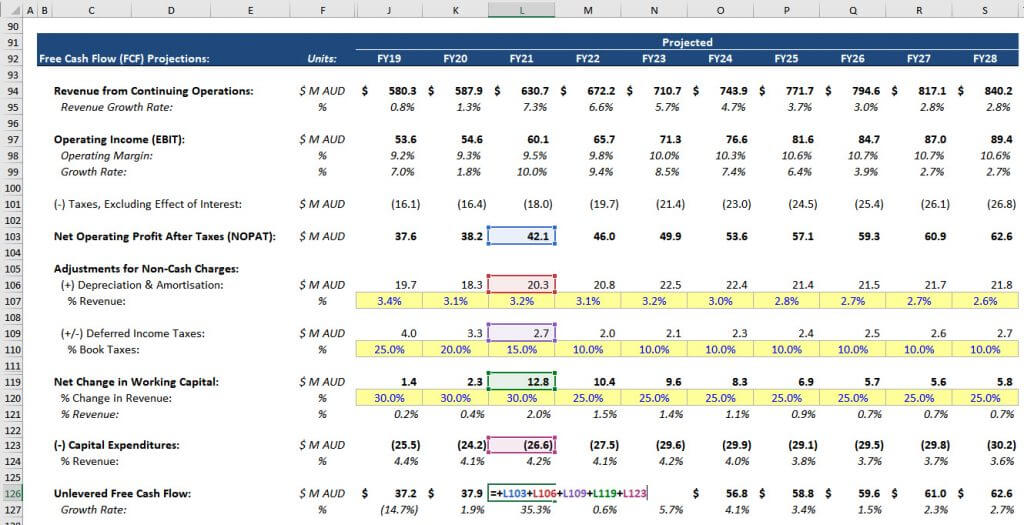

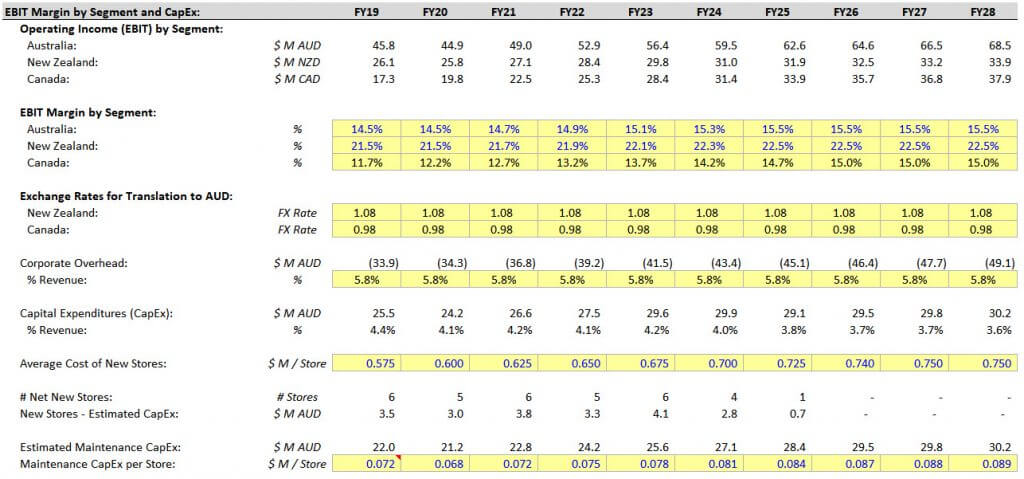

. Changes Required in a Levered DCF Analysis 1044. Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx. This metric is most beneficial when included in the discounted cash flow DCF valuation approach where.

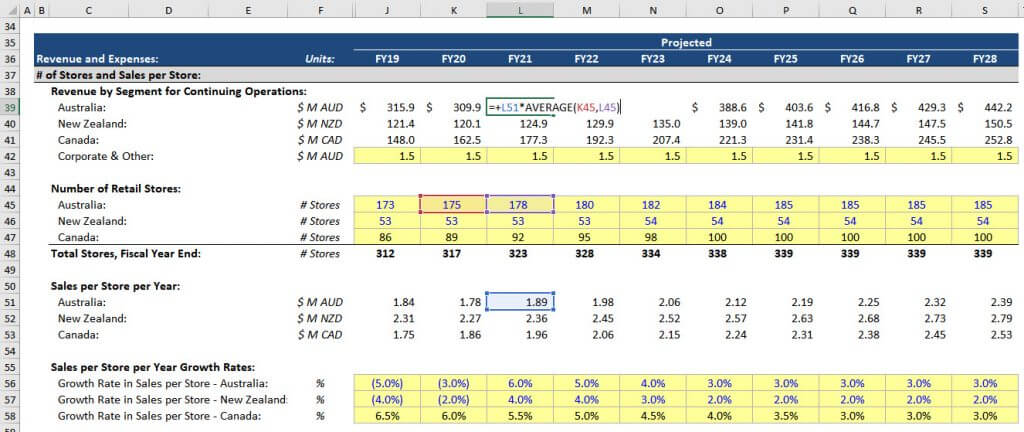

Unlevered free cash flow is a financial indicator used to determine the amount of cash earned by a business before interest and taxes are deducted. We begin the DCF analaysis by computing unlevered free cash flow. Lets see the use of the formula in the DCF model in the example below.

This metric is most useful when used as part of the discounted cash flow DCF valuation method where its benefits shine the most. In the given example we have already put historical values from financial statements into the model. Calculation of Unlevered Free Cash Flow.

Most DCF analyses use 5 or 10-year projection periods. Table of Contents for Video. The following inputs will be our basis to find the fair value.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Recap and Summary Although we always recommend. Well free cash flow should correspond with your discount rate.

Like levered cash flows you can find unlevered cash flows on the balance sheet. How to Calculate Unlevered Free Cash Flow. Levered Free Cash Flow.

Unlevered Free Cash Flow. Is Levered FCF Ever Useful. Both approaches can be used to produce a valid DCF valuation.

Multiply by 1 Tax Rate to get the companys Net Operating Profit After Taxes or NOPAT. Another reason for its prominence is that most multiple-based valuation techniques like comparable analysis. Unlevered Free Cash Flow STEP 33.

Unlevered Free Cash Flow Formula. Projecting cash flows over a longer period is inherently more difficult. A complex provision defined in section 954c6 of the US.

See the discussion of unlevered free cash flow in the valuation section for more detail on how to perform this step. Add back the companys Depreciation Amortization which is a non-cash expense. A shorter projection period increases the accuracy of the projections but also places greater emphasis on the contribution of terminal value TV to the total valuation.

To build this model we will take the data we calculated from Intel in 2020 and project what kind of value the company is worth. Why the Levered and Unlevered DCF Are Not Equivalent 1657. Unlevered FCF Net Income DA Capex Working Capital.

If you use a levered free cash flow value with interest expense subtracted you are effectively calculating an equity value with a DCF model and so discount rate is just cost of equity all other forms of capital dont matter. Unlevered FCF EBITDA CapEx Working Capital Tax Expense. The present value or leveraged free cash flow LFCF or equity cash flows discounted at the cost of.

And we know that NOPAT EBIT 1 Tax Rate. Unlevered Free Cash Flow. Unlevered Free Cash Flow Formula in a DCF.

Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs. Heres a formula for UFCF. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

Revenues 2020 77867 million. IFRS Differences for Levered FCF 1253. Unlevered free cash flow is generated by the enterprise so its present value like an EBITDA multiple will give you the Enterprise value.

If you use an unlevered free cash flow value with interest expense. This represents the companys earnings from core business after taxes ignoring capital structure. The look thru rule gave qualifying US.

Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt and equity holders. Basic Definition of Levered FCF and Excel Demo 510. The present value of the unleveraged cash flow UFCF or enterprise cash flows discounted at WACC less the value of non-common share claims such as debt.

Unlevered Free Cash Flow - UFCF. Unlevered free cash flow can be reported in a companys. Enterprise value is a measure of the companys.

Putting Together the Full Projections. Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. The differentiator between these metrics is the way they treat debtWhen debt principle payments and interest are included in the calculation FCF is said to be leveredWhen interest expenses and principle are excluded FCF is said to be unleveredThe nuance is that when FCF includes interest expense but excludes principle.

Discounted Cash Flow Analysis Street Of Walls

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

How To Calculate Unlevered Free Cash Flow In A Dcf

Unlevered Free Cash Flow For Dcf Modeling Keyskillset

Fcf Yield Unlevered Vs Levered Formula And Calculator

How To Calculate Unlevered Free Cash Flow In A Dcf

How To Calculate Unlevered Free Cash Flow In A Dcf

Unlevered Free Cash Flow Definition Examples Formula

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial